Confounding Economics: The Farm Income Mirage and How to Prepare for the Future

Allen Williams, Ph.D., Understanding Ag, LLC

Recent articles have left me scratching my head about the state of U.S. farm economics, especially looking at conflicting titles like, “Farm Income to Hit 7-Year High, Thanks to Record-Setting Aid” and “Farm Cash Receipts Forecasted to Hit a Decade-Low in 2020.” However, in a closer look, it actually makes sense. The COVID pandemic has precipitated one of the largest stopgap farm support payments ever seen, known as the Coronavirus Food Assistance Program (CFAP). Payments in 2020 are expected to total more than $37 billion to farmers and ranchers.

The result of these payments, coupled with another $14 billion on the way, will result in the highest farm income in the last seven years. This would equate to federal subsidy (traditional crop subsidies, dairy supports, federal crop insurance, disaster payments and trade war payments) and pandemic payments that constitute 36% of net farm income in 2020, the highest since 2001, when federal payments represented a 41% share of net farm income. This will take farm income to $102.7 billion in 2020, which is a 23% increase over 2019. All of this income gain comes in spite of cash receipts for crops and livestock dipping by more than 3% in 2020.

According to Pat Westhoff of the University of Missouri’s Food and Agricultural Policy Research Institute, overall farm debt will increase at a rate exceeding the value of farm assets. This will create greater chaos in the debt-to-asset ratio for many farmers. With many of these stopgap programs scheduled to end this year, coupled with commodity crop and livestock prices being stuck in a rut since 2013, net farm income in 2021 could drop precipitously. No doubt this will lead many farm groups to lobby Congress for billions in new federal aid, with political strategies and favors being curried on both sides of the aisle.

When you look at actual farm cash receipts, projections for 2020 from the USDA’s Farm Income Forecast show a $12 billion decline from 2019, a 3% decrease. This puts farm cash receipts $18 billion below the 10-year average. In 2020, roughly three out of every four dollars in federal support to farmers and ranchers is from CFAP, PPP, and programs like the trade war payments (Market Facilitation Program). However, this is still $36 billion below 2013 and 2014 gross farm income levels. Strip away these support programs and it becomes clear that the conventional farm economy is still significantly depressed.

2020 Commodity Receipts

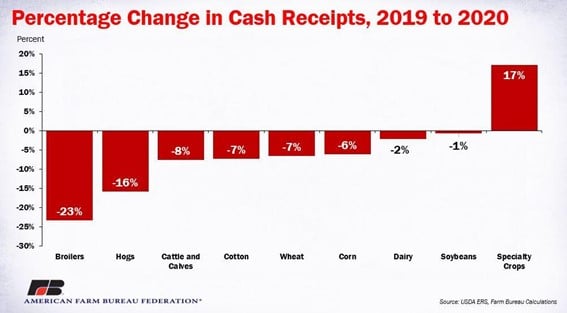

If we look at individual and group commodity livestock cash receipts, we find that poultry receipts are projected to be 23% lower than 2019 receipts, cattle 8% lower, hogs 16% lower, and dairy products 2% lower.

On the crop side, corn, soybeans, wheat and cotton are all expected to come in significantly lower in cash receipts with cotton, wheat and corn leading the way at a projected 7%, 7%, and 6% decline, respectively. The lower cash receipts in soybeans are projected to be 1%. In contrast, specialty crop cash receipts are expected to be 17% higher (See Figure 1).

Figure 1. Percent Change in Cash Receipts, 2019 to 2020.

Farm Debt Indicators

Projections for 2020 show farm debt increasing by nearly $15 billion, which is a 4% increase over 2019 farm debt. Real estate debt comprises 65% of all farm debt and has increased $14.7 billion to a new record high of $282 billion. Farm assets are projected to be $33 billion higher than in 2019, mostly due to higher farmland values.

Working capital is anticipated to fall by $10 billion, or 13%. This puts working capital at a whopping 43% below 2012 levels and 55% below 2010 levels. This translates into most farmers possessing just enough capital to service short-term debt only.

The rate of return on assets (ROA) is now thought to be less than 3% compared to 10-16% experienced from 210 to 2012. This, in turn, puts the debt-to-asset ratio at 14%. This is the highest ratio since 2002, with debt-to-asset ratios having increased every year since 2012.

What Are the Options

As I stated earlier, there will be major lobbying efforts before Congress by various farm groups to solicit billions in new farm aid packages. However, Mike Stranz, VP of the National Farmers Union, believes there is a better way besides the stopgap payments. Stranz writes…

“Lawmakers should look into solutions to the underlying problems that have plagued family farmers for decades: overproduction and corporate consolidation. From our perspective, that would mean comprehensive supply management and strong antitrust enforcement. The combination of those two policies is really the best way to ensure that farmers are independently successful.”

In our opinion (Understanding Ag, LLC) it goes much deeper than simple overproduction and corporate consolidation. Why do farmers overproduce? Why is there corporate consolidation? There are strong incentives for both. From the federal farm bill programs and the stopgap payments, to corporate interests and shareholder earnings. It is time for all of us, as farmers, to take control of our own farms and markets. We have seen many suggestions through the decades for changes to farm program policy and for laws governing corporate consolidation. As noted above, none of these measures have significantly changed the economic landscape for farmers in a positive way.

We need to realize that consumers are our real customers and start catering to their needs and desires. Regenerative farmers who were already doing so have fared well during the pandemic, with many increasing their sales anywhere from 200% to over 2000%.

Many farmers who are well down the path of regenerative practices now have little to no farm debt, are not participating in the federal subsidy and crop insurance programs and have taken no payments from the stopgap programs. They are not in need of more lobbying efforts or policy influence. They are simply following the Six Principles of Soil Health and using adaptive stewardship management to achieve their success.

Pandemic Influenced Change

A recent NY Times article details how the pandemic has altered the way American consumers shop for food. The takeaways from the article are summarized as follows:

- Fewer trips, bigger baskets with more lists/planning

- More Online ordering

- More produce buys

- New store layouts – wider aisles, better sanitation, less crowding, better payment/transaction systems

- Fewer choices and more house-brands

- Frozen category growth with “healthier, clean labels, …”

- More local foods and this interesting quote:

- “It’s all part of a greater awareness about healthy eating, food waste and climate change, as well as a desire to keep money in the neighborhood.”

What does all this mean? In short, it means more opportunity than ever before for those who are willing to take advantage. When consumers are clearly showing they want better foods, local foods, healthier and cleaner foods, are eating more whole foods than before, are placing more online orders, and buying more frozen food options, we need to jump all over this.

An opportunity to seize the day…

Many farmers and ranchers will realize more income in 2020 than anticipated due to the stopgap payments, but those payments will inevitably come to an end and then we will have to face the consequences. The conventional way of doing things has only perpetuated a long-standing problem of ever-increasing farm debt.

But there is a better way and it is through regenerative agriculture and non-traditional marketing. Opportunities abound if you take the time to truly educate yourself regarding the opportunities regenerative agriculture offers, as you cannot implement what you do not fully understand.

Marketing opportunities and investment fund opportunities are growing rapidly. In addition, for regenerative agriculture producers, there are more financial resources available now than ever before with even more coming down the pike.

A mirage will inevitably disappear but an oasis of opportunity in regenerative agriculture awaits those who plan, act and seize the day.